- Mar 18, 2025

Easy Money Tips for MoneySmart Travelnistas Living Abroad

- Sandra Morno

- 0 comments

As a MoneySmart Travelnista and digital nomad running my business abroad, managing money can sometimes feel overwhelming, even for me.

This is why it’s so important to have some strategies in place when you are abroad.

In this article, I’ll share 8 financial tips I learned while traveling abroad that can really help you save in the long run. I had to learn some of these things the hard way, but once I put them in place, I saw the savings immediately. As you travel, make sure you have some type of money system in place, especially when you are traveling and/or living abroad.

Making these changes can help you feel more confident about running your business and enjoying the benefits of living outside the US.

Let’s dive into these habits and see how they can simplify managing US business finances from abroad.

1. Spending Plan:

Make a plan for your money every month. This means deciding how much you'll spend and save. Keep track of what you earn and spend so you know where your money goes. For example, if you budget $200 for groceries but end up spending $300, it helps you adjust your spending habits.

2. Emergency Money:

Save some money for emergencies, like unexpected health issues. Loss of a client or sudden travel setbacks. Work toward saving enough to cover your living costs for three to six months. This safety net gives you peace of mind. Example, having emergency savings helped me manage unexpected flight cancellations and last-minute accommodation changes during my travels without stress.

3. Use the Right Debit/Credit Cards:

This is a simple tip but can save you a lot in fees. I had to change the cards I was using because of all the international fees, which were crazy. As a traveler, consider cards like Charles Schwab and Novo. They reimburse you for ATM fees and don’t charge international fees when making purchases. I also use Capital One and Citi; they’ve been great for me. They reimburse ATM fees and don’t charge international fees either.

Check out this [list of bank recommendations](https://wanderonwards.co/best-banks-for-expats/).

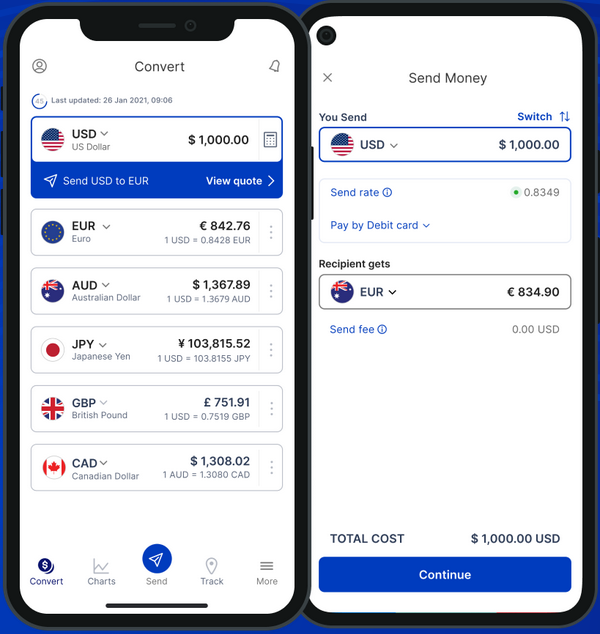

4. Watch Currency Values:

This one is HUGE! While in Argentina, people literally watched daily to see what the exchange rate would be and acted accordingly. If you caught the exchange on a good day, you could get 1.5 times more money than on a bad day, where you might lose 25% of your money. Keep an eye on currency values to know the best times to exchange money.

My go to is the XE currency app.

5. Save for Later:

Start saving for the future, even if it’s a little at a time. Look for ways to save that offer extra benefits, like tax breaks or opportunities for your money to grow. As a business owner, remember that retirement accounts can be tax deductions. Find the one that makes the most sense for you and talk to an advisor or tax professional about it.

6. Quarterly Check-Up:

Every few months, review your money situation. Check how much you’re earning, spending, and saving. This helps you stay on top of things and avoid surprises. If you notice you’re spending more than you’re earning, you can fix it before it gets worse. Plus, it makes tax season easier because everything will be organized.

7. Know Taxes:

Learn about the tax rules in the places where you live and work. Taxes can be different depending on where you are. Knowing these rules helps you avoid mistakes and penalties. For example, if you’re working remotely from another country, you might have to pay taxes there as well as in your home country. Understanding these rules helps you avoid problems.

8. Pro Help:

If your finances get complicated, consider getting help from a tax expert, especially one who knows about travel and business expenses. Tax laws can be confusing, and an expert can save you time and money. For example, if you’re a freelancer working in different countries, a tax expert can help you figure out how to file your taxes and get the deductions you deserve.

There you have it, 8 financial tips to consider while traveling. For me, the more I save, the more I can put towards my next trip. There are so many factors to consider when traveling abroad and running a business. I hope these tips have helped to make your financial process a little easier.

With a clear plan, a safety net for unexpected expenses, and a good understanding of taxes, you’ll be ready to handle any financial challenges that come your way.

You’ll feel much better knowing your finances are in order, so you can focus on growing your business and enjoying your best life abroad. Remember, the better you manage your money, the more freedom you’ll have to explore new places and try new things.

Happy travels and cheers to your business success!

Sandra Morno MoneySmart Travelnista and Tax Strategist